What are Rates?

Rates are a local property tax and the income is used to part-fund the annual day-to-day maintenance and provision of all services provided by Monaghan County Council. Rates are payable on commercial properties which have been valued by the Commissioner of Valuations (Valuation Office in Dublin).

What is the ‘Annual Rate on Valuation’ and how is it calculated?

The Elected Members of the Council determine the ‘Annual Rate on Valuation’ at the Budget Meeting each year. The Annual Rate on Valuation is determined by reference to the total shortfall in Council income, divided by the cumulative total of all valuations of rateable premises in the County (known as the Net Effective Valuation). Monaghan County Council expenditure is part-funded by government grants and income from goods and services. The shortfall between expenditure and income is funded from Commercial Rates.

The Annual Rate on Valuation for Monaghan County Council for the service year ending 31st December 2024 is €0.2445

Rates are used to fund various services such as Housing, Roads, Environmental Services and Recreation & Amenity

To access your account please click the following link: https://rates.monaghancoco.ie/#/login

Rates can be paid at the County Council or at each of the Municipal District Offices in the following ways Cash/Cheque/Postal Order/Visa Debit/Credit Card/Direct Debit/Standing Order

A property owner, or their agent, must let Monaghan County Council know where an interest in a rateable property is transferred or sold (Section 11 of the Local Government Rates & Other Matters Act 2019 refers).

The person transferring the property, either the owner or occupier, must pay all rates that are due at the time of the transfer/sale. If you fail to notify Monaghan County Council of a change in interest within 10 working days of the transfer date, this may result in a penalty for non-compliance in that, the owner becomes liable for an amount which is equivalent to the level of outstanding rates (up to a maximum of 2 years liability).

If you wish to pay your rates by direct debit you can download the forms below. Please note the standing order form should be returned to your bank and the direct debit form should be returned to Monaghan County Council.

Standing Order – Word Format

Direct Debit – Word Format

Revaluation of Monaghan Rating Authority Area

Click here to read public notice

Increased Cost of Business Grant

Data Protection

Administration & Collection of Commercial Rates Privacy Notice

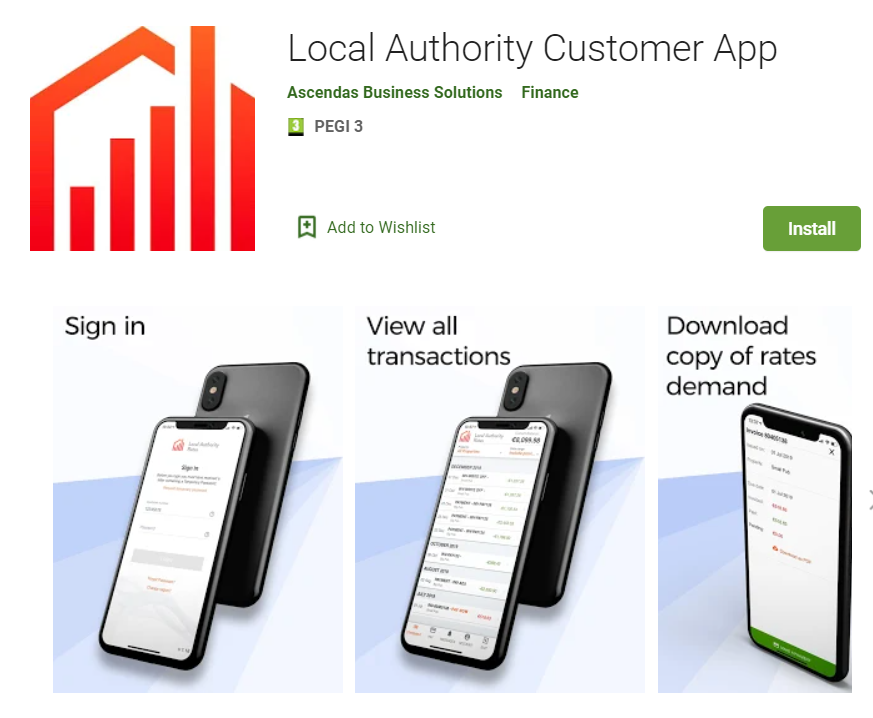

Local Authority Customer Portal

Monaghan County Council has enhanced the Rents and Rates App into one Local Authority Customer Portal. This app can be accessed via smart phone, tablet or computer.